tax avoidance vs tax evasion australia

Tax avoidance means legally reducing your taxable income. Incorrectly classify revenue as capital.

Pandora Papers Line Between Tax Avoidance Tax Evasion Becomes Blurred

Tax fraud is a serious crime and carries a maximum penalty of up to 10 years imprisonment.

. Tax Evasion refers to the adoption of illegal methods for reducing liability of payment of taxes such as manipulation of business accounts understating of incomes or overstating of expenses etc whereas Tax Avoidance is the legal way to reduce the tax liability by following the methods that are allowed in the income tax laws of the country such as taking permissible deductions etc. It is illegal. The Government of any country offers areas and multiple options to the public and entities in reducing and encouraging investments that serve as tax-saving instruments.

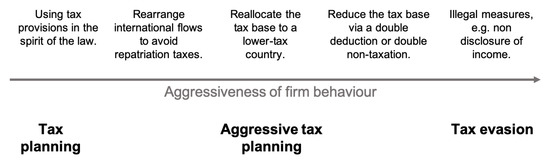

An unlawful act done to avoid tax payment is known as Tax Evasion. The main objective of a tax advisor is to assist hisher clients avoid taxes as much as possible through within the confines of the law in order to avoid crossing the line into tax evasion. This basic principle of taxation law is supported by the definitions of tax avoidance and tax evasion.

Tax evasion means concealing income or information from tax authorities and its illegal. It may also structure arrangements to. In this case the tax advisor guides hisher clients based on the law regarding tax avoidance and tax evasion.

5 million in 4 billion through tax evasion in 201314 In the audit the IRS finds errors that the taxpayer knowingly and willingly committed A French court found Swiss bank UBS AG guilty of illegally soliciting clients and laundering the proceeds of tax evasion ordering it to pay 4 Tax Court Cases. Kansas vs Tax Court Cases. While you get reduced taxes with tax avoidance tax evasion can result in fines penalties imprisonment or.

Whereas tax avoidance although not illegal are ways in which the taxpayer uses strategies to minimise tax within the limits of the law. A planning made to reduce the tax burden without infringement of the legislature is known as Tax Avoidance. Illegally release super funds early.

Tax evasion The failure to pay or a deliberate underpayment of taxes. Chapter 8 Tax avoidance and tax evasion Introduction Tax avoidance and tax evasion can next section explains the motivation to products illegally traded across decrease the economic welfare for tax avoidance and tax evasion borders. Many different Federal and State offences fall.

II THE AUSTRALIAN APPROACH TO TAX AVOIDANCE AND TAX EVASION It is generally acknowledged that tax evasion constitutes an act outside the law whereas tax avoidance is considered an act within the law. Tax fraud also commonly known as tax evasion is the illegal abuse of the taxation system for financial benefit. Its illegal and carries serious consequences.

If you have information about someone you think may be participating in phoenix tax evasion or shadow economy activity you can report it to us confidentially online. Exploit concessional tax rates. The difference between tax avoidance and tax evasion boils down to the element of concealing.

The following are the major differences between Tax Avoidance and Tax Evasion. The tip-off form only takes a few minutes to complete. Tax avoidance is defined as legal measures to use the tax regime to find ways to pay the lowest rate of tax eg putting savings in the name of your partner to take advantage of their lower tax band.

Tax Avoidance Vs Tax Evasion Essays About Love A Five Paragraph Classification Essay Example. In tax evasion you hide or lie about your income and assets altogether. Not declaring income to the taxman.

Illicit trade is defined in by making tobacco products more and categorizes these motives based Article 1 of the. In Australia tax fraud is criminalized by both the Federal Government and State Governments. These strategies are commonly referred to as tax minimisation.

To summarise tax avoidance is a legal and legitimate strategy while tax evasion is illegal and results in harsh punishments. Tax avoidance refers to hedging of tax but tax evasion implies the suppression of tax. Tax evasion is a serious offense and those found guilty can be fined andor jailed.

However this should refer to wilful misrepresentation of tax affairs as some companies may. A tax avoidance scheme may include complex transactions or distort the way funds are used in order to avoid tax or other obligations. Tax evasion is taking illegal steps to avoid paying tax eg.

In tax avoidance you structure your affairs to pay the least possible amount of tax due. Underground economy Money-making activities that people dont report to the government. Tax evasion occurs when there is a legitimate attempt to get out of paying tax.

Common examples of tax evasion include non-reporting or underreporting of. A taxpayer who intentionally hides income by lying concealing information or committing fraud where they associate income or assets with someone else has committed a willful act known as tax evasion. The first distinction is tax evasion which usually refers to illegal tax-reducing arrangements.

In legal terms there is a big difference between tax avoidance and tax evasion. Try to provide as much detail as you can so we are able to fully assess the information see Making a tip-off. Tax avoidanceAn action taken to lessen tax liability and maximize after-tax income.

Tax Evasion is a known fraud of not paying the liable taxes while Tax Avoidance is a well-structured plan to identify methods to reduce the outflow towards tax payments. Tax avoidance and tax evasion.

The Difference Between Tax Avoidance And Tax Evasion Is The Thickness Of A Prison Wall Denis Healey Tax Quote Quotes Qotd Prison Building Old Wall

Chart The Global Cost Of Tax Avoidance Statista

Explainer The Difference Between Tax Avoidance And Evasion

Wkisea Treading The Fine Line Between Tax Planning And Tax Avoidance

Explainer What S The Difference Between Tax Avoidance And Evasion

Double Tax Avoidance Agreement Dtaa Advantages And Misuse

Tax Avoidance Png Images Pngwing

Tax Evasion And Tax Avoidance Explained Pdf Tax Avoidance And Tax Evasion Explained And Studocu

Difference Between Tax Avoidance And Tax Evasion Difference Between Tax Avoidance And Tax Evasion Every Assessee Wants To Escape From Paying Taxes Course Hero

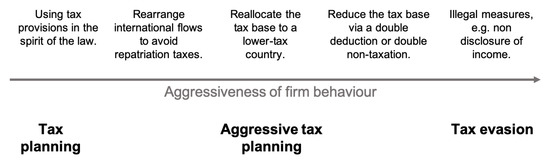

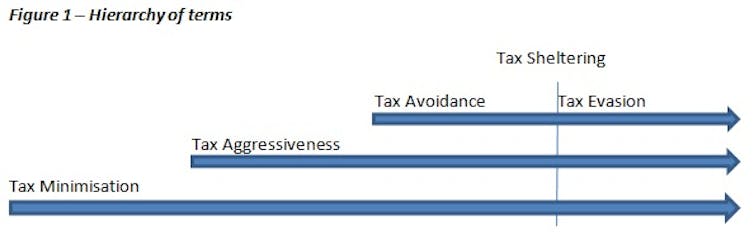

Games Free Full Text Gaming The System An Investigation Of Small Business Owners Attitudes To Tax Avoidance Tax Planning And Tax Evasion Html

Tax Avoidance Difference Between Tax Evasion Avoidance Planning

Tax Avoidance Vs Tax Evasion Infographic Fincor

Most Likely Core Elements Of The Associations On Tax Avoidance Tax Download Table

Investopedia Video Tax Avoidance Vs Tax Evasion Investing Millionaire Mindset Wealth Building

Tax Evasion Is Unlawful Tax Avoidance Is Legal To Arrange Your Affairs In A Such A Way So As To Minimize Tax Is Quite Legal Tax Avoidance Www Trustdeedr

Anti Tax Avoidance Measures In China And India Faculty Of Law

Why It S Time To Talk About Corporate Tax Schroders Global Schroders

Tax Avoidance Difference Between Tax Evasion Avoidance Planning